Exness Account Types

Exness presents a variety of account types distinguished by factors like minimum deposit, commissions, margin requirements, spreads, and leverage. Your choice of account isn’t just a decision; it’s a strategic move that shapes the toolkit and tactics at your disposal.

Navigate your trading journey wisely, as selecting the right Exness account type is the key to optimizing your operations, ensuring you have the ideal instruments and strategies to make every trade count.

Exness offers several account types, each designed with specific trader needs in mind.

| Account Type | Minimum Deposit | Commission | Spread Type | Leverage | Suitable for |

| Standard | $1 | No | From 0.3 | Up to 1:2000 | Beginners |

| Standard Cent | $1 | No | From 0.3 | Up to 1:2000 | Newcomers with lower risk |

| Pro | $200 | No | From 0.1 | Up to 1:2000 | Experienced traders |

| Raw Spread | $200 | Yes | From 0.0 | Up to 1:2000 | Traders preferring low spreads |

| Zero | $200 | Yes | Zero on some | Up to 1:2000 | High-frequency traders |

Choosing an Exness Account Type

When selecting the best Exness account for your trading needs, it’s also crucial to consider the following aspects to ensure you make the most informed decision.

- Exness provides access to MetaTrader 4 and MetaTrader 5, two of the most popular and powerful trading platforms available. Each platform offers unique features and tools, so consider which platform aligns best with your trading strategy.

- Fast order execution is critical, especially for strategies that rely on quick market entries and exits, such as scalping. Exness is known for its high-speed order execution, which can significantly benefit your trading performance.

- The quality of customer support can greatly enhance your trading experience. Exness offers 24/7 customer support in multiple languages, ensuring that help is always available when you need it.

- For those looking to expand their trading knowledge, Exness provides a wealth of educational materials, including webinars, tutorials, and articles. These resources can be especially beneficial for beginners and traders looking to refine their strategies.

- Security is paramount in online trading. Exness takes the security of its clients’ funds seriously, employing advanced security measures and segregating client funds from company funds to ensure maximum protection.

Exness is regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). Trading with a regulated broker provides traders with peace of mind regarding the safety of their funds and the integrity of their broker’s operations.

Create a New Trading Exness Account

When initiating a fresh trading account, it seamlessly integrates into your current Personal Area (PA). The creation of additional trading accounts comes at no cost, eliminating the necessity to enroll in a new Client Area.

Trading Account Limit

In the Personal Area (PA), there is a limit of 100 for all types of trading accounts (except for the standard cent) for MT4 and MT5, as well as for live and demo accounts. These limits were introduced to reduce the load on the exchange’s servers.

| MT4 Real | MT4 Demo | MT5 Real | MT5 Demo | Total |

| 100 | 100 | 100 | 100 | 400 |

Create a Demo Account

Demo accounts serve as invaluable tools for honing your skills and gaining confidence before diving into live trading. Upon your registration in the Personal Area, an automatic creation of a demo account, loaded with $10,000 in virtual currency, awaits you in the Demo tab within the My Accounts section. Should you desire additional practice accounts, you have the flexibility to create them within your Client Area.

Changing the Account Type

Unfortunately, once a trading account is created, it cannot be changed to another type. You can create new trading accounts in your Personal Area (PA) to use the trading account type at your discretion.

We recommend that you carefully choose a trading account type that suits your trading style.

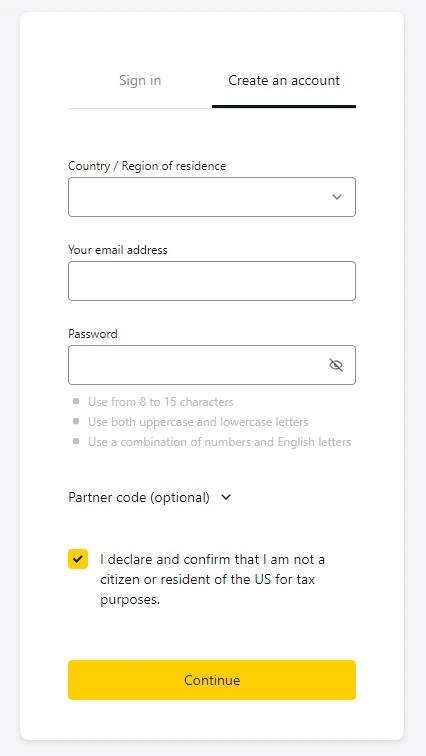

How to Open an Exness Account

Opening an account with Exness is a straightforward process:

- Start by clicking on the “Open Account” button.

- Fill in the registration form with your personal information, including your name, email address, and phone number.

- To comply with regulatory requirements, you’ll need to verify your identity and residence by submitting the necessary documents, such as a passport and a utility bill.

- Once your account is verified, you can make a deposit using one of the several payment methods available on Exness. The minimum deposit amount varies depending on the account type.

- Start Trading with your account set up and funded, you’re now ready to start trading on the Exness platform.

- Start with a Demo Account. Before trading with real money, practice your strategies on a demo account. This will help you familiarize yourself with the trading platforms and conditions without risking your capital.

Exness Demo Account

Exness Demo Account is a feature-rich platform designed to offer a risk-free trading environment for both new and experienced traders. This account type allows users to practice trading strategies, get familiar with the Exness trading platforms, and understand market dynamics without the risk of losing real money.

Exness Islamic Account

The Exness Islamic Account caters to traders who follow the Islamic faith and require their trading activities to comply with the principles of Sharia law. This type of account is also known as a swap-free account because it does not involve any swap or rollover interest on overnight positions, which is prohibited under Islamic law.

Features and Benefits:

- Swap-Free. This means traders can hold positions overnight without incurring any interest, aligning with Sharia law’s prohibition on Riba (interest);

- No Hidden Fees. Transparency is a key component, with no hidden charges or fees applied to transactions, ensuring that trading activities remain fair and straightforward;

- Access to All Trading Instruments. Traders can access a wide range of trading instruments, including forex, commodities, and indices, allowing for a diversified trading portfolio;

- Account Setup. Traders must first register for an Exness account and then request the Islamic account feature, subject to approval and verification of their faith if required;

- Trading Activity. Once the account is set up, traders can engage in trading activities across various instruments without worrying about accruing interest;

- Monitoring and Management. Traders should regularly monitor their accounts, manage trades effectively, and utilize risk management strategies to protect their investments.

Exness ECN Account

The Exness ECN Account is designed for traders who prefer direct access to the currency markets with better and faster execution. ECN stands for Electronic Communication Network, and this type of account connects traders directly to liquidity providers, enabling tighter spreads and more competitive pricing.

Features and Benefits:

- Direct Market Access. Traders enjoy direct access to other participants in the currency exchange market through an ECN.

- Lower Spreads. Due to the direct market access, ECN accounts often feature lower spreads compared to traditional accounts.

- Transparency. The ECN model provides a high level of transparency, as it allows traders to see the market depth and available liquidity.

- Account Registration. Interested traders need to sign up for an Exness account and select the ECN account option during registration.

- Market Participation. Once the account is active, traders can start trading immediately, benefiting from direct market access and low latency execution.

- Strategy Implementation. With an ECN account, traders can implement sophisticated trading strategies, including scalping and algorithmic trading, to capitalize on market movements.

Summary

Exness trading platform emphasizes the importance of choosing the right account type to improve trading efficiency. Exness emphasizes the need to consider factors such as trading platforms (MetaTrader 4 and 5), order execution speed, customer support, educational resources, security and regulatory compliance to make informed decisions. Exness offers different types of accounts, including an Islamic account that complies with Shariah law and an ECN account for direct market access. Account creation is simple, integrated into the user’s personal account for free, although there is a limit of 100 accounts. Account types are fixed at the time of creation, but additional accounts can be created. Opening an account involves filling out a registration form, passing identity verification, and depositing funds, and it is recommended to use a demo account for risk-free practice.

FAQs: Exness Account Types

What are the main differences between the Standard and Professional account types at Exness?

The main differences lie in the trading conditions and target audience. Standard accounts are more suited to beginners or those who prefer simplicity, offering no commissions and reasonable spreads. Professional accounts, like the Raw Spread, Zero, and Pro accounts, cater to experienced traders and offer lower spreads (sometimes as low as 0.0 pips for Raw Spread and Zero accounts) but may include commissions on trades. Professional accounts also provide a broader range of features and tools designed for sophisticated trading strategies.

Can I switch between Exness account types?

Yes, Exness allows you to open multiple accounts and switch between different account types. If you wish to change the type of an existing account, you may need to open a new account with your preferred type and transfer funds accordingly.

Are Exness accounts available in all countries?

Exness operates in many countries worldwide, but due to regulatory and legal restrictions, their services might not be available in certain jurisdictions. It’s best to check directly on the Exness website or contact their customer support to confirm availability in your country.

How do I open an Exness Demo Account?

Opening an Exness Demo Account is straightforward. Visit the Exness website and find the option to open a demo account. Provide the required personal information. Select the demo account type that best suits your needs. Download and install the trading platform (MetaTrader 4 or MetaTrader 5). Start trading with virtual funds to practice and develop your strategies.

Is there a minimum deposit for Exness accounts?

The minimum deposit varies by account type. Standard accounts typically have very low minimum deposit requirements, making them accessible to a wide range of traders. Professional accounts might require a higher minimum deposit, especially for those offering more competitive trading conditions.

What instruments can I trade with Exness?

Exness offers a wide range of trading instruments across different account types, including forex pairs, metals, cryptocurrencies, energies, indices, and stocks. The availability of specific instruments may vary depending on the account type.